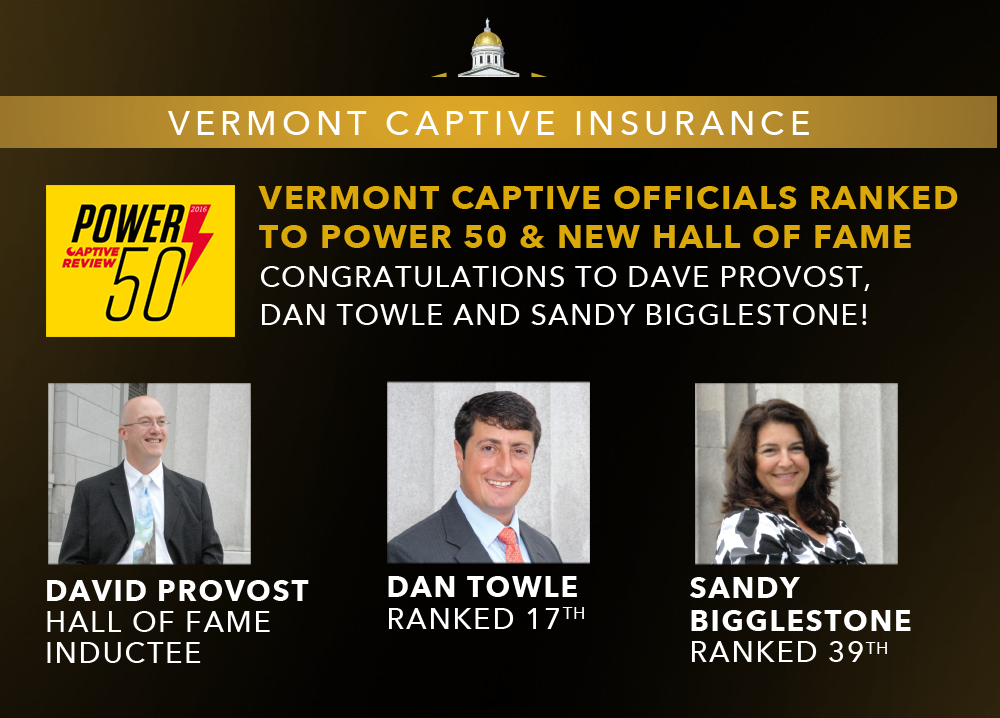

Montpelier, VT- Dave Provost, Dan Towle and Sandy Bigglestone have all been recognized by Captive Review Magazine, a leading London-based publication for the captive insurance industry for their influence in the global captive insurance industry. The magazine has published, for the first time, an industry-wide Hall of Fame recognizing the most influential individuals the captive insurance industry has produced, or been served by, over the past 50 years. Vermont’s own Dave Provost has been selected as one of 13 inductees chosen for this prestigious honor. Sandy Bigglestone makes the “Power 50” list for the first time and Dan Towle moves up in the ranking, voted on by more than 4,800 industry professionals.

“Dave, Dan and Sandy represent a great group of hardworking individuals at the State and we are proud of them and the entire captive insurance team,” said Vermont Governor Phil Scott. “Their leadership and expertise in the captive insurance industry has significant impacts across the globe and to our State’s economy. This recognition comes as no surprise to those of us here in Vermont, and we are honored that the global captive industry recognizes them as well.”

Vermont’s chief regulator, David Provost, Deputy Commissioner of the Captive Insurance Division has been named the most influential person in the captive insurance world four times in his career. In light of this, and numerous other accomplishments, Dave was chosen as one of the first inductees to the Captive Review Hall of Fame. Two other Vermonters were also recognized in the Hall of Fame, Leonard Crouse and Edward Meehan, Provost’s predecessors in the Captive Insurance Division.

“David Provost, Vermont’s deputy commissioner for captive insurance, has been an almost permanent resident in the top five of our Power 50 in recent years and was number one again in 2015. He, deservedly, has graduated to the Captive Review Hall of Fame in recognition of his continued service and dedication to the industry,” said Richard Cutcher, Editor of Captive Review Magazine.

Dan Towle, Director of Financial Services for the Agency of Commerce & Community Development moved up to be 17th on the distinguished list.

“Dan Towle has held a unique position within the global captive industry for 17 years and, alongside David, is a respected and knowledgeable ambassador for Vermont,” said Cutcher. “I know many domiciles around the world envious of the contribution he makes.”

New on the roster, Sandy Bigglestone (CPA, CFE), Director of Captive Insurance for the Vermont Department of Financial Regulation now sits 39th on the list.

“Sandy Bigglestone has worked within Vermont’s captive division for 20 years, rising up the ranks to serve as director of captive insurance,” said Cutcher in recognizing her achievement. “Her knowledge of captive insurance and risk retention groups, in particular, are highly valued within the department and by the service providers and risk managers she works with.”

Bigglestone, Towle and Provost combined have over 50 years of service with the State and represent the ‘Gold Standard’ of captive insurance.

The State of Vermont is not the only star in the poll results. A prestigious group of industry providers based out of the Green Mountain State have risen in the ranks including, Nancy Gray, Aon Insurance Managers (14); Rich Smith, Vermont Captive Insurance Association (22); Julie Boucher, Marsh Management Services (30); Bob Gagliardi, AIG Insurance Management Services (34); and John Prescott, Johnson Lambert LLP (36) were recognized.

“We tout our industry infrastructure as the best in the world,” said Towle. “The large number of captive insurance professionals based in Vermont that are recognized on this list are a big part of what makes us the ‘Gold Standard’ of domiciles.”

Captive insurance is a regulated form of self insurance that has existed since the 1960’s, and has been a part of the Vermont insurance industry since 1981, when Vermont passed the Special Insurer Act. Captive insurance companies are formed by companies or groups of companies as a form of alternative insurance to better manage their own risk. Captives are typically used for corporate lines of insurance such as property, general liability, products liability, or professional liability. Growth sectors of the captive insurance industry include professional medical malpractice coverage for doctors and hospitals, and the continued trend of small and mid-sized companies forming captive insurance companies.